Are Leveraged ETF’s Good For Your Financial Health?

In today’s blog we explore the world of leveraged ETFs. For those of you who are not familiar with ETFs (Exchange-Traded Funds), they are mutual funds that are bought and sold like stocks.

The majority of ETFs are passively managed and based on some index, allowing the investor to purchase a single fund that represents an entire asset class. Not only are there ETFs that address the larger asset classes, such as the S&P 500 or the BarCap Aggregate Bond, there are also ETFs that focus on much narrower asset classes such as small cap US stocks, emerging markets bonds, etc.

A few years ago ProShares Advisors and Direxion Funds introduced what are commonly called leveraged ETFs. These are ETFs that double or triple the daily returns (or losses) of an un-leveraged ETF. Why would anyone want to buy such a product? Well, if you really believed that some asset class was extremely undervalued, it would be like doubling down on your investment without having to shell out any additional money. But such a gambling analogy is unfortunately very appropriate. Even ignoring the increased risk of loss when the asset class moves in the wrong direction, the real problem is that over time the returns you get will be very unexpected.

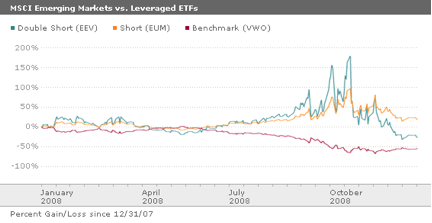

Take emerging markets, for example. Below is a chart from Morningstar showing the cumulative return during 2008 for three ETFs: the Vanguard Emerging Markets Stock ETF (VWO) in red, which tracks an emerging markets stock index; the Short MSCI Emerging Markets ProShares ETF (EUM) in yellow, which shorts the same index (that is, returns the opposite of the index); and the UltraShort MSCI Emerging Markets ProShares ETF (EEV), which double shorts the same index. For example, if the index is up by 2% on a given day, VWO would be up by 2%, EUM would be down by 2%, and EEV would be down by 4%.

Take a look at the chart. After one year, VWO was down a bit over 50% (consistent with the index). But EUM was not up by 50% as you’d expect; instead it was up by only half that. And EEV, which you’d expect to be up by double the index, actually lost money.

How can this be? It’s because of the mathematics of compounding returns over time. These funds work as expected if index returns are always increasing or always decreasing. But when they go up and down over time, as most investments do, the cumulative results can be very surprising. The worst case is when an asset class rises, and then falls back to its starting point over some period, such as some commodities did in 2008. In such a case, if you were to calculate the daily returns for the leveraged and un-leveraged ETFs tracking the index and apply them cumulatively, you’d find that the cumulative return for the un-leveraged ETFs would end up close to zero, while the returns for the leveraged ETFs, whether long (up) or short (down), would all be double-digit negative.

And it’s not like the fund companies don’t warn you. Direxion, for example, includes “daily” in the name of its leveraged ETFs. And a fact sheet lists the products as suitable only for sophisticated investors who understand “the consequences of seeking daily leveraged investment results.” Nonetheless, investors typically hold these ETFs for much longer that a single day, and that’s where the problems occur. “Leveraged ETFs kill portfolios,” said Paul Justice, associate director of ETF research at Morningstar. “They are probably too complex for most individual investors.”

There are over 800 non-leveraged ETFs available in the market today with total assets exceeding $1 trillion. That’s more than enough to craft a portfolio covering any number of asset classes if that’s the approach an investor wants to take. We don’t see any need to utilize leveraged ETFs in prudent, risk-managed portfolios. But if it’s gambling you want, we’ve heard of a great place in Vegas…