Remember Meme Stocks? Where Are They Now?

The year 2021 might be remembered as the year of the incautious investor. Non-fungible tokens (NFT) and Special Purpose Acquisition Companies (SPAC) were all the rage, bitcoin ETFs were on the verge of breaking out, and everyone was buzzing about the unexpected price surges of GameStop and AMC Theaters, the two so-called meme stocks.

In this article we will revisit the latter. (If you don’t know why they’re called meme stocks, it comes from the use of small images known as memes on the internet to pump up interest). Prior to 2021 both companies’ stocks had been languishing, with short selling frequently exceeding long buying. A social media investment influencer named Keith Gill bulked up on a lot of options on each of those stocks and began to promote them on platforms such as Reddit. As followers started buying up the stocks, driving up their prices, short sellers were forced to sell at higher and higher prices. This is known as a short squeeze and helped to accelerate the stock price increases.

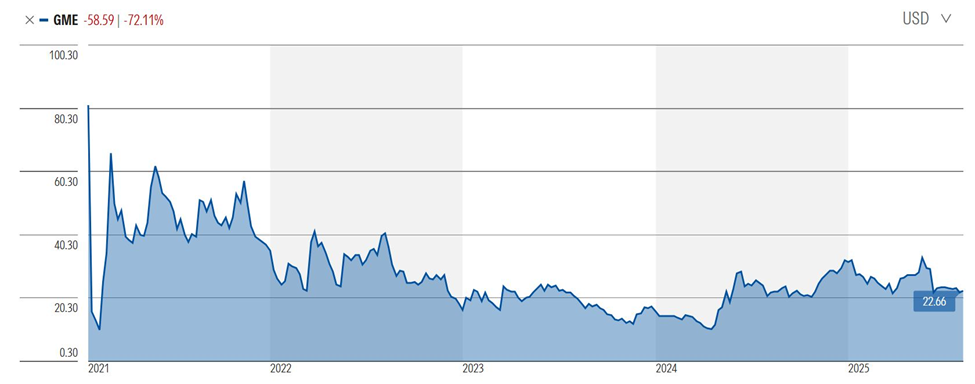

If you had invested in either of those stocks at that time and had held onto them until today, you will likely have regretted both decisions. Here’s a chart from Morningstar of GameStop’s price from early February 2021 through August fifth of this year (as of this writing). Its value has declined by over 72%.

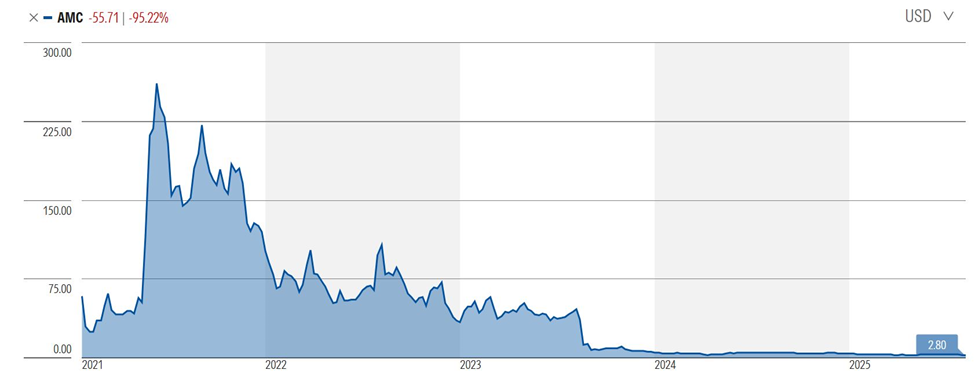

AMC has fared even worse. From a high above $286 in early June, 2021, its value has plunged over 95% to under $3 over the same period.

Note that Gill’s involvement in GameStop was investigated by the SEC, but he was never indicted for illegal market manipulation. The bar for that crime is relatively high, and since he primarily used memes to generate interest in the stock, he could not be accused of making false statements or failing to disclose his options holdings. He was sued several times by private investors, but the lawsuits were subsequently dropped.

What’s the message here? It’s simple. Just as social media can be a very poor source of factual news, it can also be a very poor source of good investment advice. Caveat lector.

(Artie Green is founder of Cognizant Wealth Advisors dba Perigon Wealth Management, LLC, a registered investment advisor. For more information visit cognizantwealth.com. More information about the firm can also be found in its Form ADV Part 2, which is available upon request by calling 877-977-2555 or by emailing compliance@perigonwealth.com).