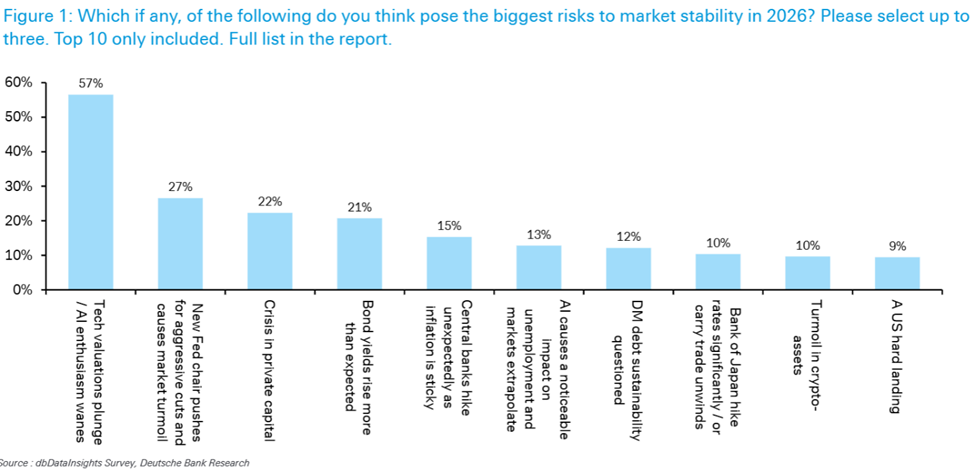

Biggest Risks To Market Stability in 2026

What worries you the most about your investment portfolio in 2026? Deutsche Bank (DB) surveyed 400 asset managers about their concerns as part of DB’s recently released 2026 Global Markets Survey.

As you can see from the chart, respondents’ biggest worry by far is the technology bubble bursting in 2026. More than half the respondents (57%) identified this as their number one risk. The top ten stocks in the S&P 500 – most of them technology – now comprise over 40% of its total market cap. If Nvidia, Microsoft, Apple, Alphabet, or any of the others should falter, the S&P 500 would take a big hit. What might cause that? Possibly a profitability decline if these companies’ revenues fail to keep up with their AI spending. Or if AI does not live up to investor hype. Or some unexpected global event such as the U.S. invading Greenland.

According to Jim Reid, DB’s Head of Thematic Research, 57% was the highest consensus of any risk factor throughout the history of these annual surveys. Last December only 36% of respondents were most concerned about a tech bubble. At that time the greatest concern was a global trade war.

The second-highest risk identified by respondents is Trump politicizing the Federal Reserve by installing a new chairperson who follows Trump’s demands for more aggressive rate cuts. That’s a clear statement by asset managers that an independent Fed is extremely important for capital market stability.

Other responses indicate ongoing concerns about private capital growth & risks, inflation, rapidly shifting bond rates, cryptocurrency growth & risks, and the possibility of a recession. But at the moment all are dwarfed by the current high valuations in the stock market. The S&P 500 has risen over 16% in 2025, 19% in 2024, and 24% in 2023. This level of growth is just not sustainable.

It’s tempting to react to information such as this by selling or buying assets. But if you keep your portfolio well-diversified across many uncorrelated asset classes and maintain enough stable assets to cover your cash needs for the next year (or more) then you really shouldn’t have much to worry about. That’s what financial planning is all about.

(Artie Green is founder of Cognizant Wealth Advisors dba Perigon Wealth Management, LLC, a registered investment advisor. For more information visit cognizantwealth.com. More information about the firm can also be found in its Form ADV Part 2, which is available upon request by calling 877-977-2555 or by emailing compliance@perigonwealth.com).