How Ethical Is Your Financial Advisor?

Once again, investment advisor ethics are in the news. A new study from the Diligence Review Corp., a firm that provides due diligence analyses of investments and investment advisors for private and institutional clients, determined that only 10% of the nearly $50 trillion in managed assets is in the hands of companies adhering to the highest standards.

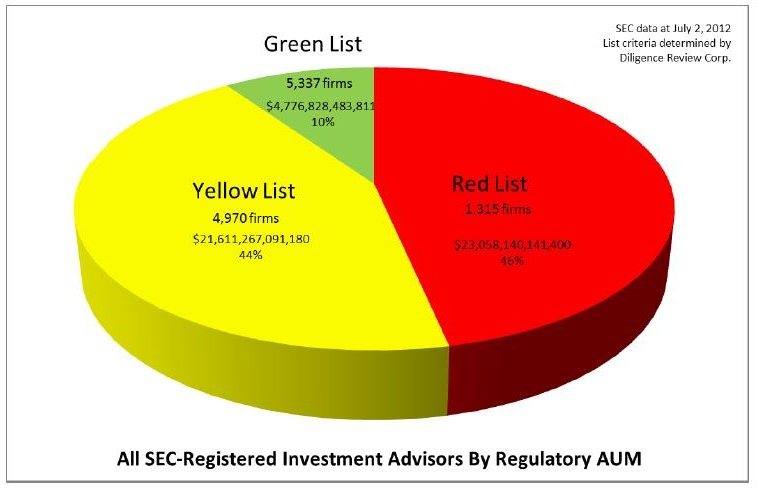

Diligence’s study was based on a review of 11,622 advisory firms registered with the Securities and Exchange Commission. They assigned each firm a red, yellow, or green rating. Red applied to firms with regulatory violations or other breaches of conduct. Yellow applied to firms that, while violation-free, utilized a business model with possible conflicts of interest, such as selling financial products on a commission basis while offering financial advice at the same time. The green firms had no violations and no apparent conflicts of interest. The results are as follows:

The good news is that 5,337 firms made the green list. That’s over 45% of the total number of firms. The bad news is that these firms manage less than $4.8 trillion of the $50 trillion in managed assets. That means that 90% of all managed assets are in the hands of firms that have had past run-ins with regulators or possible conflicts of interest built into their business models.

According to Charles Passy at Smart Money magazine, critics argue that Diligence’s standards are unreasonably strict. Some financial professionals complain that it’s very rare for a large, well-established firm to have a totally clean record and that a minor infraction from a few years back may have little relevance. Others say that what Diligence perceives as potential conflicts are commonly accepted practices throughout the industry – for example, the hybrid model of firms that both sell products and provide advice – and such firms still may have thousands of satisfied clients.

Nevertheless, Jennifer Cooper, managing director for Diligence, suggests that the color codes can be used as a tool to help investors research advisors. We agree that a high ethical standard should be one of the three top criteria for selecting an advisor (the other two being competence and caring about clients). The challenge up to now has been the difficulty of assessing the ethical standard of someone you do not personally know. While this study may help, keep in mind that it only addresses firms regulated by the SEC, not those smaller firms (such as Cognizant Wealth Advisors) that are regulated by the various state regulators.

Here’s a link to the report, including the companies that were reviewed: http://www.diligencereviewcorp.com/reports/red-yellow-green-report/. Do you think this represents a good way to determine advisor ethics?