Are Stock Prices Poised For A Fall?

Among the numerous economic and financial indicators that investment advisors utilize in an attempt to predict future stock market performance there is a pretty broad consensus that company profit margins (or earnings per share) are one of the better predictors. The challenge, of course, is the difficulty of predicting future profit margins. Currently for the companies comprising the S&P 500 the average is over 10%, an all-time high. Is this level of earnings sustainable due to some kind of structural change in the economy? If so, then we should expect continued growth in company stock prices. If not, then prices are likely to fall.

The “This Time Is Different” faction suggests that technological progress has led to productivity gains, enabling corporate profit margins to have reached a permanently higher plateau. They additionally point out that service businesses – which have much higher profit margins than industrial companies – make up a larger portion of total corporate revenues today. But Baijnath Ramraika and Prashant Trivedi of Multi-Act, an Indian equity research company, analyzed the drivers of corporate profits and could not find any basis for either argument.

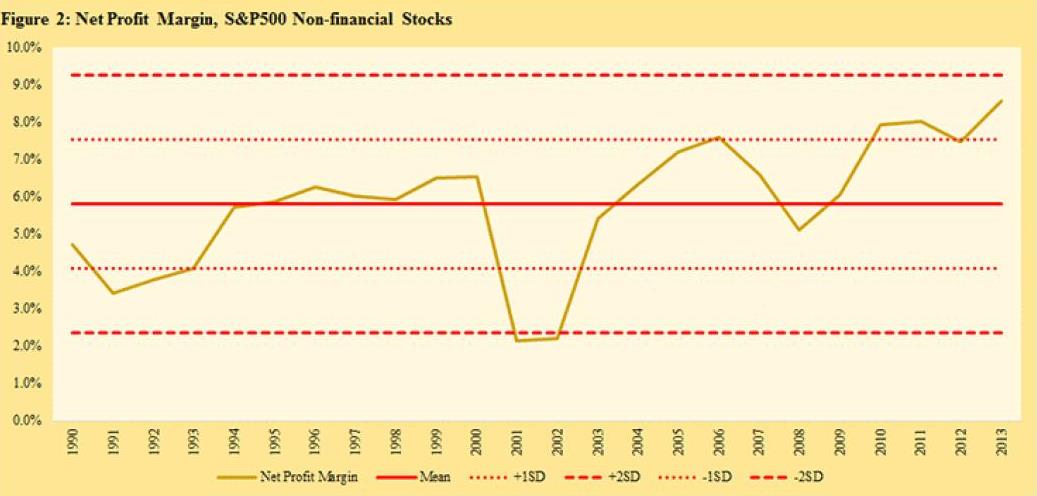

On the other side, Jeremy Grantham, of GMO, believes that nothing has changed, and that company earnings have nowhere to go but back down to their historical mean of around 6%. “Profit margins are probably the most mean-reverting series in finance, and if profit margins do not mean-revert, then something has gone badly wrong with capitalism. If high profits do not attract competition, there is something wrong with the system and it is not functioning properly.” Indeed, the data from Ramraika and Trivedi make a strong case for Grantham’s viewpoint. The two analysts looked at average profit margins for non-financial S&P 500 companies since 1990. (Financial companies were excluded because their accounting is different). You can see in the chart below that average earnings have been about 6%.

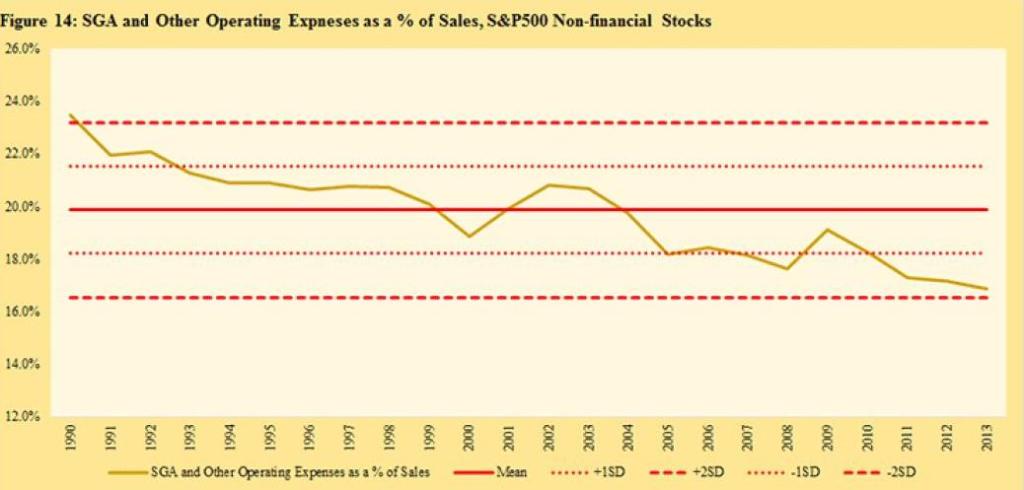

Ramraika and Trivedi attempted to identify the sources of increasing corporate profits over this period of time. After examining numerous expense categories, they found two. The first is a prolonged reduction in marketing, advertising, R&D, software development and product promotion expenses, as can be seen in the chart below.

What’s behind this shift? They speculate it has to do with CEO tenures, which have been declining significantly over the last several decades. CEOs have been under increasing pressure to show bottom line growth in the shortest time possible, and these expenses are among the easiest for executives to manipulate to bulk up company profits.

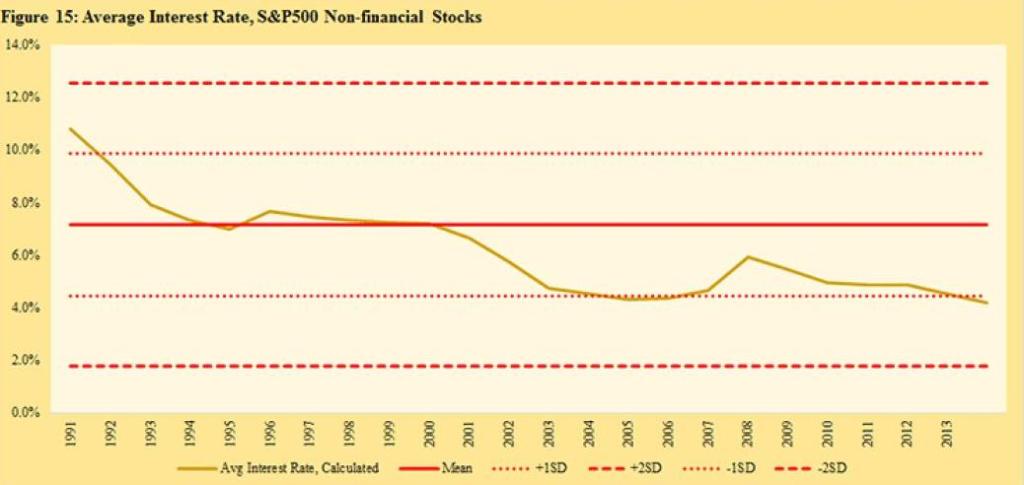

The other expense driving the increased profits is corporate borrowing costs, which have dropped well below their mean, mostly as a result of declining interest rates over the period. See chart below.

The net of all this is a strong indication that corporate earnings are being buoyed at historically high levels by the increasingly short-term focus on bottom-line performance by executive leaders together with historically low borrowing costs. The former actions – cutting SGA expenses and postponing capital investments – will have an impact on business’ competitiveness in the future, likely reducing future earnings. The latter factor will have an outsized negative impact on earnings when interest rates start to rise. Ramraika and Trivedi calculated that an increase in borrowing costs to their mean level could reduce corporate net profits by as much as 11%.

What does this mean for investors? Coming off two very good years for equity returns (2013 and 2014), it’s easy to fall into the trap of believing that double digit returns will continue, especially with the U.S. economy currently doing well. But this research suggests a high likelihood that corporate profits will decline from their current highs. The potential consequence is likely to be flat or negative returns for stock investments at some point in the future.

This is not to suggest that you should sell all your stocks now. We have no idea about the timing of such events. And there are no other asset classes in which you can put your money and expect anywhere near the returns that stocks provide. But there are times when prudence should take a front row seat in the investment world, and this may be one of them. Be sure to set your expectations for stock market growth realistically.

One Response

Nice analysis, thanks. Of course at a higher, even fuzzier level you can just say that inevitable reversion to the mean NO MATTER THE REASON indicates unlikeliness for the current run-up in valuations to hold indefinitely. What this analysis does for me, at least, is to provide next-level rationales for WHY a reversion to the mean shouldn’t be surprising.