Why Is The Stock Market So Disconnected From The Economy?

Does it seem to you that the stock market is totally disconnected from the reality of the economy? Business news has been as bad as it gets. The number of unemployed workers has reached record-setting levels while GDP has declined to levels not seen since the 1930s. Federal debt has increased by over $3 trillion. At the same time the federal government’s response to the COVID-19 pandemic has been erratic and leaderless. Yet the S&P 500, after losing more than 30% in March, has bounced back nearly 40% since that time. What’s going on?

Actually the market is behaving quite normally. It’s important to recognize that markets are forward-looking. That is, current asset prices reflect investors’ expectation of future corporate earnings. Although the currently reported economic data sounds bleak, investors are not basing the prices they’re willing to pay on how companies are performing today but rather on how they think they’ll be doing multiple quarters into the future.

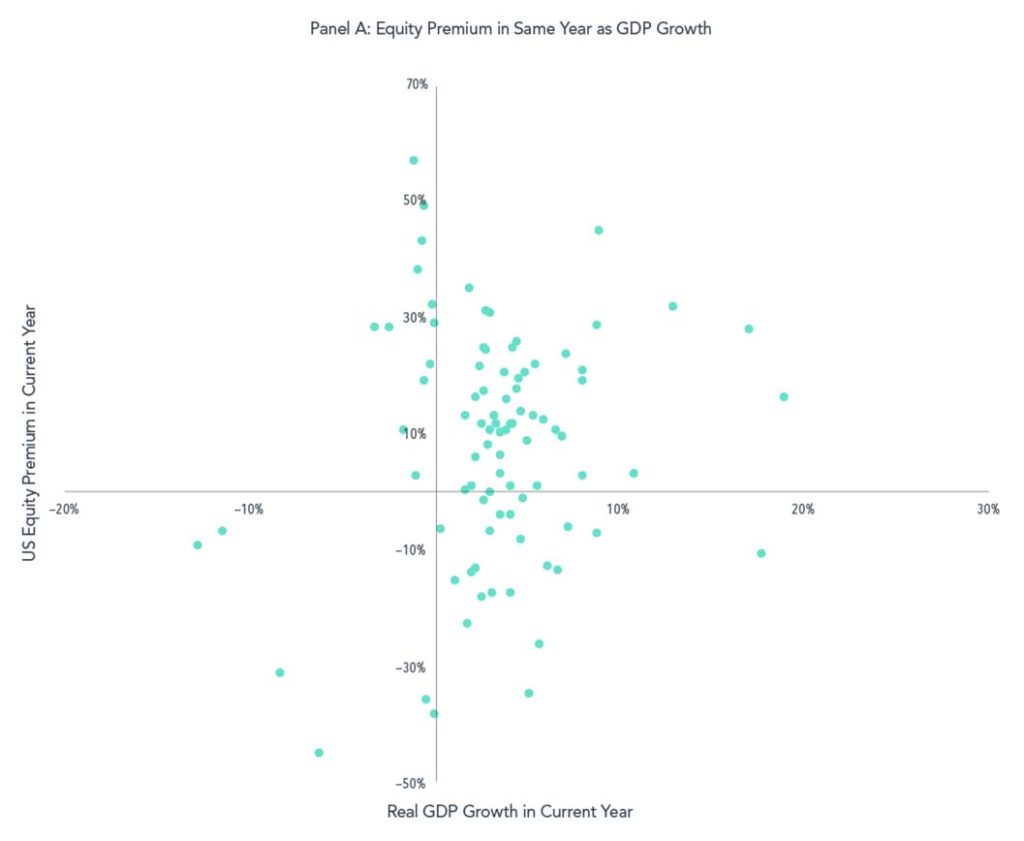

This behavior has been demonstrated statistically by Dimensional Fund Advisors. They plotted annual GDP growth against the same year’s excess stock market returns (excess meaning the returns above risk free one-month U.S. Treasury bills) over the past 90 years and found no discernable relationship between the two.

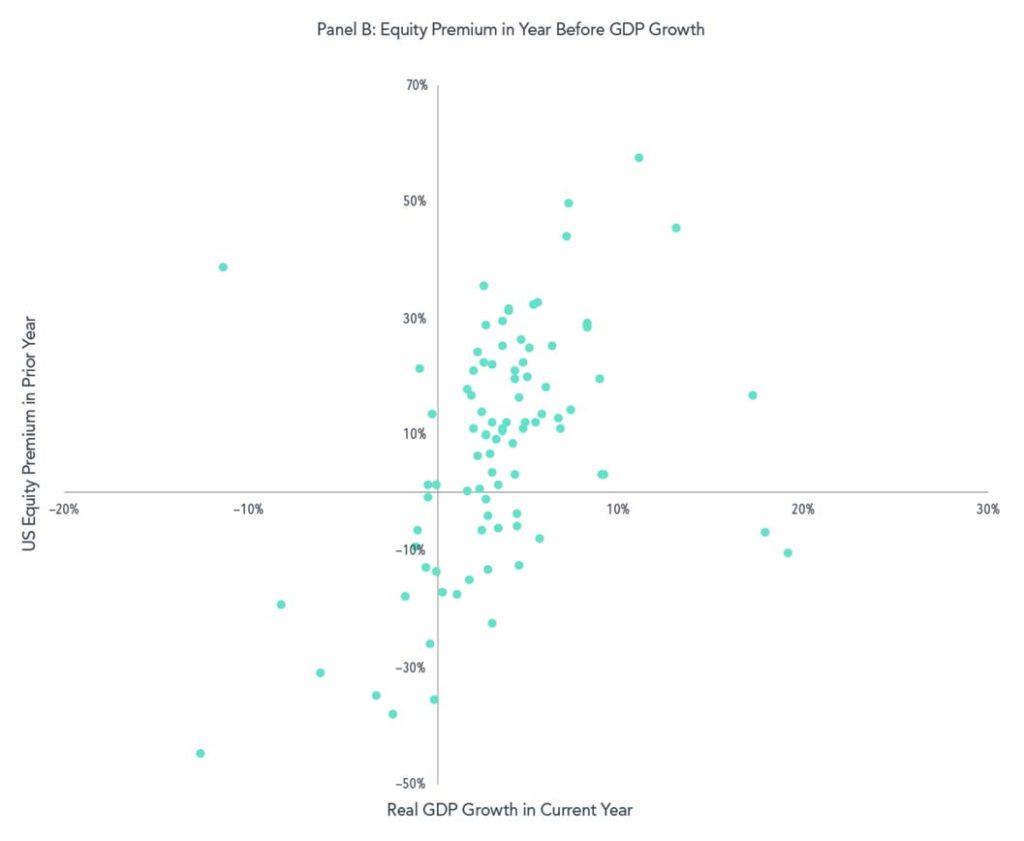

Then they compared the same GDP growth against the previous year’s excess market returns. The trend between the two is clearly positive. The higher the previous year’s returns, the higher the following year’s GDP growth.

This isn’t to say that the stock market always gets it right. As you can see from the outliers there have been years when equities were positive but the following year’s GDP growth turned out to be negative. And vice-versa. The point though is that the market does appear to be pricing in expectations of future rather than current economic activity. Even more interesting is how well they seem to track.

What is the market telling us today? Investor sentiment is largely optimistic with respect to the economy bouncing back fairly quickly, which also means assuming that the COVID-19 pandemic will be brought under control in the not too distant future. Could this change quickly? Certainly, if something unexpected were to happen over the next few months. For the present, though, a large number of investors see things improving over the near-term. That’s encouraging to me!