In Memoriam: Harry Markowitz

Harry Markowitz died last month.

You probably didn’t hear about it in the traditional media sources. They tend to limit their obituaries to entertainment and sports stars, politicians, and other well-known personalities. Yet I contend that Markowitz has had a much greater impact on your life than practically any of those others.

Markowitz was the originator of Modern Portfolio Theory (MPT), the foundation on which CFP® professionals are trained to base their investment portfolio allocation recommendations. I’ve written frequently about diversification. Markowitz was the first to recognize that diversification in portfolio construction reduces risk.

Prior to the creation of MPT investment advisors focused primarily on identifying individual stocks with the greatest expected return. (Some still do). They came up with numerous valuation methods for their recommendations, all of which were based in the end on little more than guesswork. And there was hardly any analysis performed on the risk or variability of a stock’s expected return.

Markowitz decided to utilize mathematics to try to quantify the risk associated with stock market uncertainty for his Ph.D. dissertation in economics at the University of Chicago. His ground-breaking work, Portfolio Selection, was published in The Journal of Finance in 1952. (Milton Friedman, one of his advisors, jokingly said that he couldn’t give Markowitz a Ph.D. in economics because his dissertation wasn’t about economics). Among other things Markowitz demonstrated that for a given level of expected return it’s possible to construct a lowest risk portfolio.

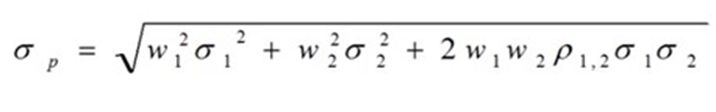

As a math major myself I admire elegant formulas. One of my favorites comes from MPT:

What it says in English is that you can reduce the standard deviation of returns of a stock portfolio by including stocks whose returns are less correlated with each other. This concept is fundamental to the way many financial planners approach portfolio allocations. You cannot control returns, but you can control risk.

In addition to MPT Markowitz was one of the first to rigorously apply statistical analysis to stock investing. He also anticipated the advent of behavioral finance by recognizing that investors frequently deviate from building optimal portfolios for emotional and other reasons.

Although I never had the opportunity to meet Harry Markowitz, much of the advice I and my firm provide to clients derives from his work. He will be missed.