Should You Invest After A New Market High?

Now that the stock market has reached new highs again after a dismal 2022, you might be thinking that this would be a bad time to buy stocks since they’re more expensive than they previously were. My recommendation is to buy anyway.

Over the past ten years there were almost 260 days in which the S&P 500 attained a new high. If you were to avoid buying after one new high, you’d miss out on the growth leading up to the next one. Of course there’s lots of variability with the timing. In 2021 there were 70 new highs, primarily because they tend to cluster during market upturns, and the S&P 500 gained nearly 27% that year. But there were no new highs in 2023. Why? Because it took over a year for the market to recover following its steep decline in 2022. And after a robust double digit return in 2023, the S&P 500 has established new daily highs over 20 times so far this year and is currently up over 6%. How would you know which of all the new highs signals the right time to buy in?

Putting aside the timing question, the whole reason we invest in the stock market in the first place is to grow our savings above inflation from our working years through a multi-decade retirement. And it has delivered, returning on average about 9.5% annually for the better part of a century. Although stock market annual returns can be volatile, on average they’ve been positive every two out of three years.

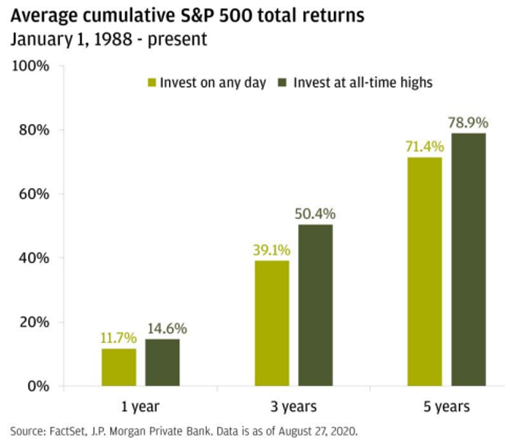

Perhaps the most interesting data comes from an analysis by JP Morgan in 2020. See the chart below:

They calculated the cumulative one, three, and five-year returns generated by the S&P 500 starting on every individual trading day between January 1, 1988 and August 27, 2015 (2017 for the three-year and 2019 for the one-year returns). The average of each is represented by the light green bars. They compared that to the average of the one, three, and five-year returns gotten from investing on only those days during the same period that represented a new high (the dark green bars). As you can see, investing on a day with a new high would have actually increased your chances of getting a better return as compared to investing on any random day.

This is not to suggest that it’s better to invest on days enjoying new stock market highs. Rather it’s to point out that there’s no good reason not to. And if you’re still worried about jumping into the market right before a possible downturn, you can always dollar-cost average your investment by spreading it out over several months or quarters. You’re going to be investing your savings for a long time so that they’ll grow and support you in your future. You should experience lots of new highs along the way no matter when you invest.